Medicare

Medicare can be confusing, especially while you are being overwhelmed with mail pertaining to Medicare. There are many options, so it is important to take the time to get educated on all of your options before choosing your Medicare Insurance. An agent can help simplify this process.

Types of Medicare Insurance

Part D – Prescription Drug Coverage

Part D – Prescription Drug Coverage

Part D plans are Medicare plans that cover your prescriptions. You can purchase these by themselves if you have Medicare Parts A and/or B only, or if you have a Medicare Supplement. To select the best prescription plan for you we take a look at your medications and the pharmacy you use.

Medigap is Medicare Supplement Insurance that helps fill “gaps” in.

Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

- Copayments

- Coinsurance

- Deductibles

Medicare Advantage also known as Medicare Part C – allows Medicare beneficiaries to receive Medicare-covered benefits through private health plans instead of through Original Medicare. Advantage plans often include additional benefits – beyond those included in Medicare Part A and Part B – such as prescription drug coverage, dental and vision coverage, and even gym memberships.

Medicare Advantage also known as Medicare Part C – allows Medicare beneficiaries to receive Medicare-covered benefits through private health plans instead of through Original Medicare. Advantage plans often include additional benefits – beyond those included in Medicare Part A and Part B – such as prescription drug coverage, dental and vision coverage, and even gym memberships.

Medicare Advantage enrollees pay Part B premiums (deducted from Social Security checks for beneficiaries receiving Social Security) plus the premium for their Medicare Advantage plan. Some Medicare Advantage plans have no premium at all, leaving the beneficiary to only pay the Part B premium.

Medicare Advantage plans have built-in caps on out-of-pocket costs, which is not the case for Original Medicare.

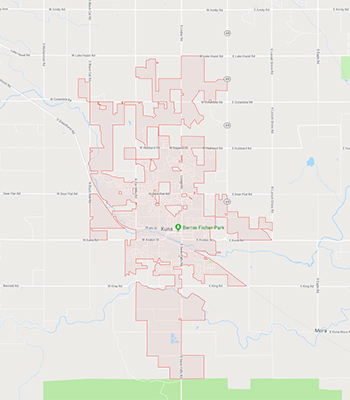

But Medicare Advantage coverage is typically limited to a network of providers, usually in a local area — as opposed to Original Medicare’s nationwide coverage area. An Advantage plan may be an HMO, PPO or private fee-for-service plan, but it must be approved by Medicare and follow its guidelines.

During the annual Medicare open enrollment period (October 15 through December 7), Medicare beneficiaries can change Advantage plans, switch from Medicare Advantage back to Original Medicare or vice versa. Changes made during open enrollment are effective on January 1.

Medicare is the federal health insurance program for:

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

The different parts of Medicare help cover specific services:

Medicare Part A (Hospital Insurance)

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people are automatically signed up.

Medicare Part B (Medical Insurance)

Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

Medicare Part C (Medicare Advantage Plans)

A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits. Options vary greatly by county, state, and region.

Medicare Advantage Plan options can include:

- Health Maintenance Organizations

- Preferred Provider Organizations

- Private Fee-for-Service Plans

- Special Needs Plans

- Medicare Medical Savings Account Plans

If you’re enrolled in a Medicare Advantage Plan:

- Most Medicare services are covered through the plan

- Medicare services aren’t paid for by Original Medicare

Most Medicare Advantage Plans offer prescription drug coverage.

Medicare Part D (prescription drug coverage)

Part D adds prescription drug coverage to:

Part D adds prescription drug coverage to:

- Original Medicare

- Some Medicare Cost Plans

- Some Medicare Private-Fee-for-Service Plans

- Medicare Medical Savings Account Plans

These plans are offered by insurance companies and other private companies approved by Medicare. Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare Prescription Drug Plans.